Transform the Future of Finance

Robinhood was founded on a simple idea:

that our financial markets should be accessible to all.

With customers at the heart of our decisions, Robinhood is lowering barriers and providing greater access to financial information and investing. Together, we are building products and services that help create a financial system everyone can participate in.

Are you ready to be a part of it?

“The talent that we hire today will build the products of tomorrow and will further drive us to fulfill our mission.”

Vlad Tenev

Co-Founder and CEO

Investing in You

Well-being - Premium medical, dental, and vision insurance

Family & home life - Parental leave, personal prosperity benefits

Comfort & care - Annual lifestyle stipend

Office life - Catered meals and fully stocked kitchen, commuter benefits

Growth - Education and training, community events, career mentorships

What We Value

at Robinhood

Working at Robinhood

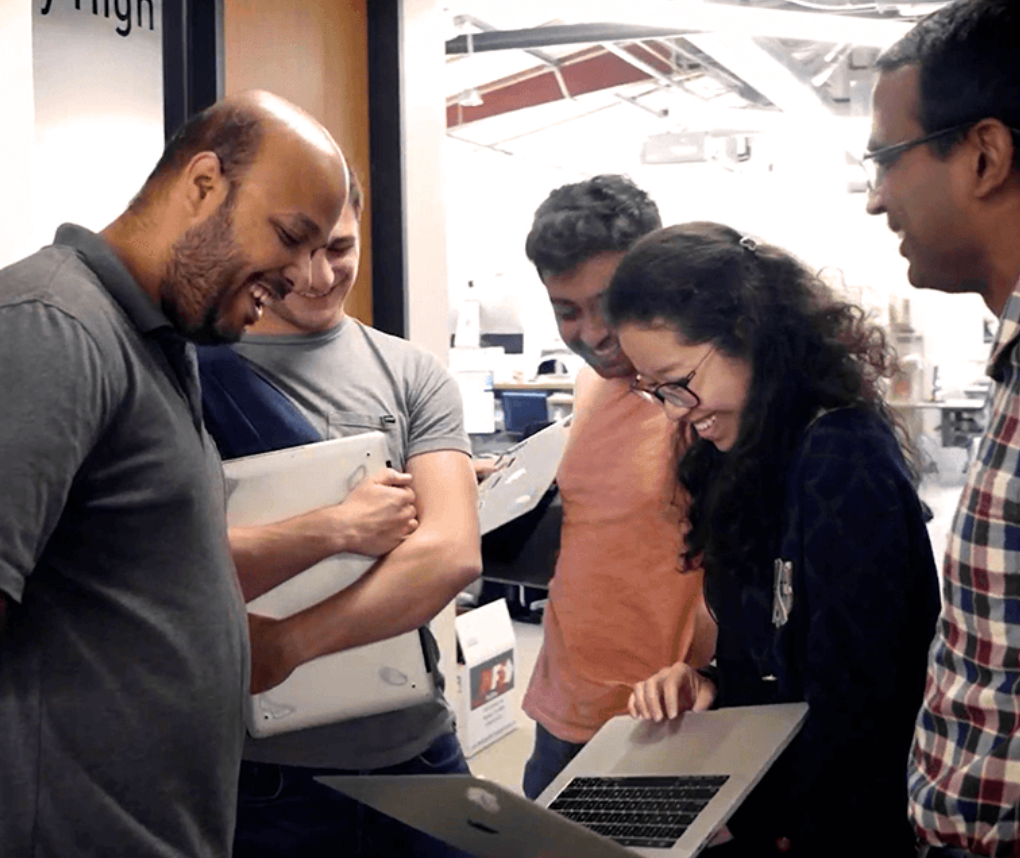

At Robinhood, our culture thrives on in-person collaboration and a strong commitment to community. Most roles are office-based, with team members coming together at least three days a week to foster creativity and innovation. Our collective effort extends beyond business, deeply rooted in democratizing finance and driving meaningful community engagement.

The Robinhoodie Community

Attracting, supporting, and retaining diverse talent is critical to delivering on our mission. We strive for our workforce to reflect our customer base and broader communities everywhere.

60% of our employees are members of the following Robinhood Employee Resource Groups (ERGs), which are identity or experience-based groups led by members and allies who join together to support building our inclusive workplace.

- Asianhood

- Black Excellence

- Divergent

- Latinhood

- Parenthood

- Rainbowhood

- Robinhood Veterans

- Sisterhood

- Women in Tech

Regular Connections

We believe in open and direct two-way communication. One way we foster that at Robinhood is our regular all-hands meetings led by our co-founders. They offer every team member the opportunity to engage directly with our leadership, stay informed about company developments, understand our strategic direction, and feel the pulse of the community.

Work Locations

Our office culture is designed to maximize creative problem-solving and foster strong team connections. We're committed to achieving our ambitious goals more effectively by uniting our talents in a shared space. Recognizing the value of remote work, we also have a community of remote employees and offer certain roles for remote hiring based on business needs and job requirements. Our approach aims to harmonize the benefits of both environments, ensuring flexibility and inclusivity for all team members.

Office Locations:

- Menlo Park, California

- New York, New York

- Bellevue, Washington

- Washington, DC

- Denver, Colorado

- Westlake, Texas

- Chicago, Illinois

- Lake Mary, Florida

- London, United Kingdom

- Toronto, Canada

Community Engagement

At Robinhood, the External Affairs and Community team embodies our commitment to democratizing finance for all through meaningful community engagement and innovative social impact. To do this, we work with a broad and diverse range of mission-aligned people and organizations. Learn more by visiting our Environmental, Social & Governance (ESG) program website.

Join Us in Democratizing Finance for All!

Robinhood is not just about where we work; it's about how we work together, regardless of location. If you're excited about contributing to a dynamic, diverse, collaborative team, we invite you to explore our career opportunities. Together, let's transform the future of finance!

Join Our Team

Filter by:

- All categories

Sorry, no jobs were found for that criteria.

Don’t see the role that you’re looking for?

Stay up to date on the latest happenings at Robinhood and get notified when we post new job opportunities that match your interests.

Robinhood takes pride in being an equal opportunity employer in the regions where we operate.

Robinhood Markets, Inc. and our global business entities are proud to be equal opportunity employers. We do not discriminate based on race, color, religion, national origin, age, sex, marital status, ancestry, neurotype, disability, veteran status, gender identity, sexual orientation or any other category protected by local law.

If you need additional assistance throughout the hiring process related to a health condition or there is something our team can do to enable a more accessible experience, please notify our team by completing this Applicant Accommodation Form.

Under the U.S. Transparency in Coverage act, Robinhood is required to provide U.S. pricing information to U.S. consumers before they receive care under our insurance plans. To review Robinhood’s U.S. medical insurance pricing structure, please click here: https://transparency-in-coverage.collectivehealth.com/index.html.

To learn more about how we process your personal information and your rights in regards to your personal information as a Robinhood Applicant, please visit our Robinhood Applicant Privacy Policy page.

Robinhood means Robinhood Markets, Inc. and its family of wholly-owned subsidiaries.

U.S. brokerage services are offered through Robinhood Financial LLC, a registered broker dealer and U.S. clearing services through Robinhood Securities, LLC, a registered broker dealer.

U.K. brokerage services are offered through Robinhood U.K. Ltd, an authorised and regulated firm by the U.K. Financial Conduct Authority (FRN: 823590). U.S. cryptocurrency services are offered through Robinhood Crypto, LLC.

EU cryptocurrency services are offered for eligible EU customers through an account with Robinhood Europe, UAB (company number 306377915), registered in Lithuania as a virtual currency exchange and virtual currency depository wallet operator.

The Robinhood Money spending account is offered through Robinhood Money, LLC, a licensed money transmitter.

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news.

© 2024 Robinhood